In-house legal departments worldwide are facing unprecedented challenges in today's fast-paced and ever-evolving business landscape. From budget cuts to resourcing issues to the need for more efficient solutions, General Counsels (GCs) have their work cut out for them. To shed light on these challenges, Wakefield Research surveyed GCs in the US, Australia, Hong Kong, Singapore, and the UK, as hired by Axiom.

Here are some of the key insights and trends that emerged, showcasing the common struggles and the unique nuances across these markets.

Budget Cuts Put Values to the Test

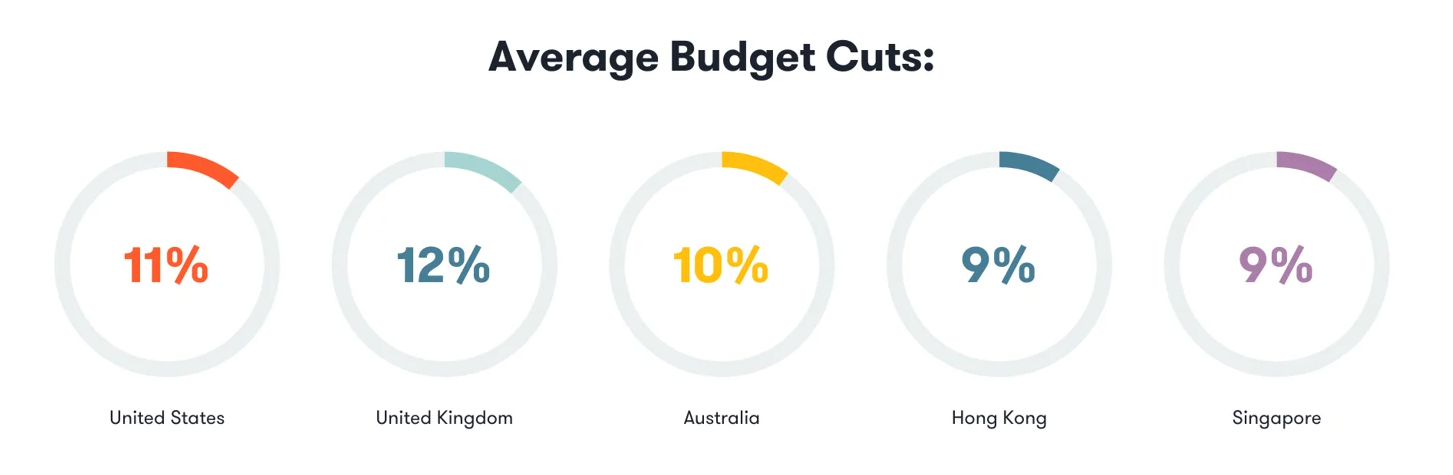

During this global recessionary economy, it’s no surprise that budget cuts are a pressing issue for legal teams and departments everywhere. According to our surveys, the average budget cuts in the past 12 months ranged from 9-10% in Australia, Hong Kong, and Singapore to 11-12% in the US and UK. Nearly all GCs (91-100%) said their departments' budget has been cut due to economic conditions.

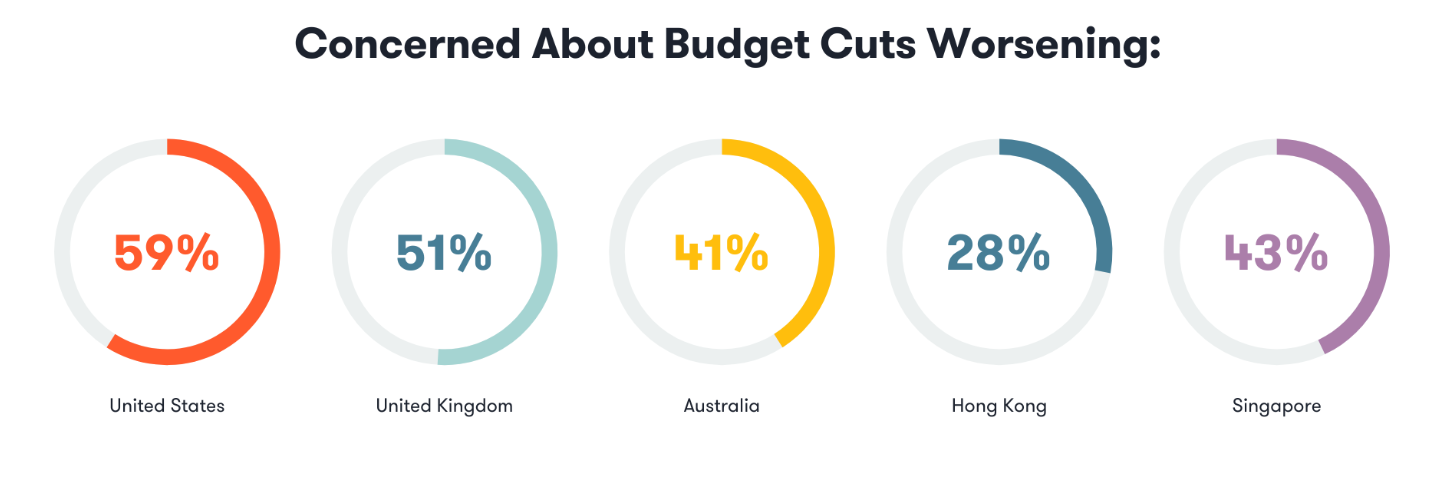

These constraints are forcing tough choices between budget and values. 27-38% of GCs across markets said they've already had to prioritize budget over values, with the highest in Australia (37%) and the lowest in the UK (27%). If conditions worsen, another 52-66% expect to face this dilemma, with the US (59%) and UK (51%) most concerned.

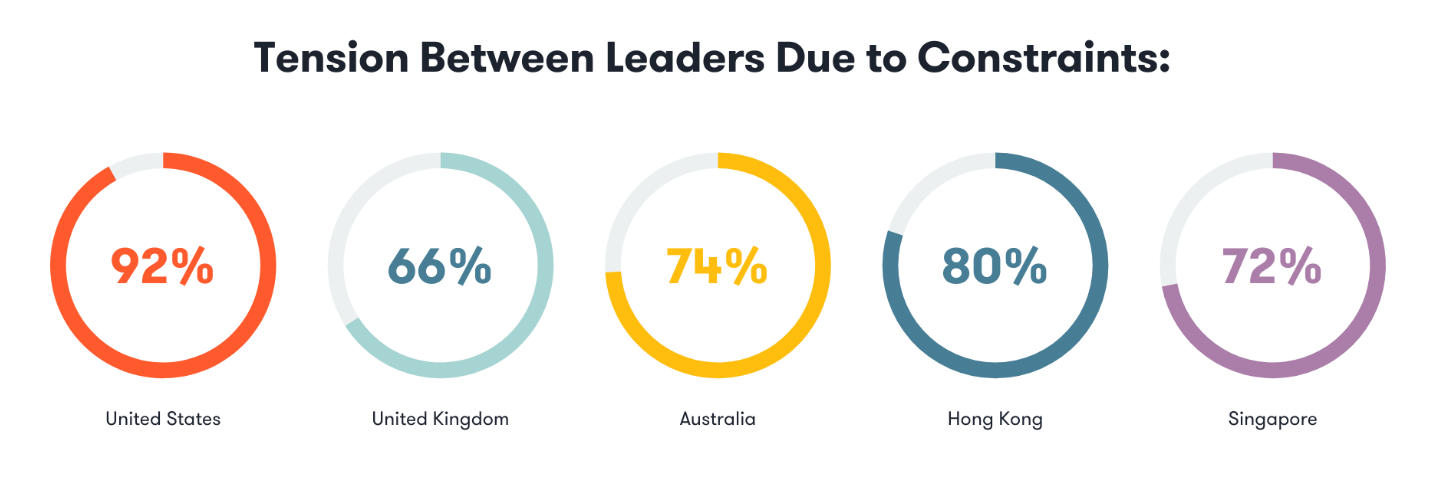

With constraints in place, tension with other leaders over values seems like a natural next step; 90-95% of GCs in the US, Australia and Singapore have faced this at least once versus 80% in Hong Kong and 66% in the UK. Over half of US GCs (54%) have experienced it multiple times.

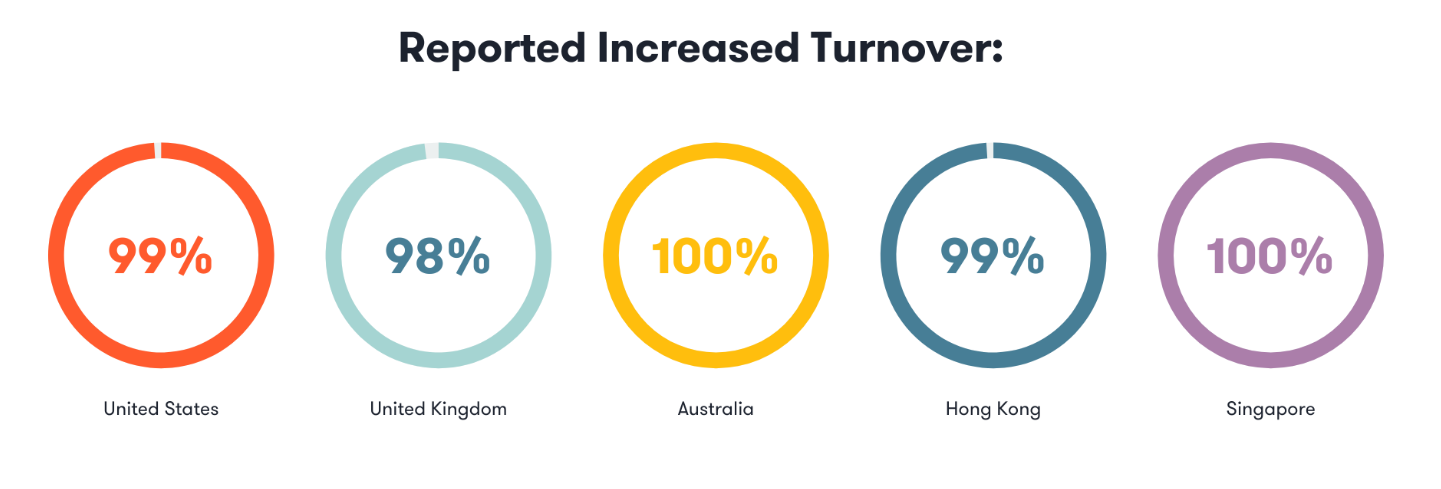

Budget cuts are impacting talent retention too with 98-100% of GCs reporting increased turnover and around 25% seeing significant increases. The US and Australia were most concerned about being unable to invest in talent if cuts continue (63-65% very/extremely concerned vs. 57-61% elsewhere).

Limitations of Traditional Law Firm Support

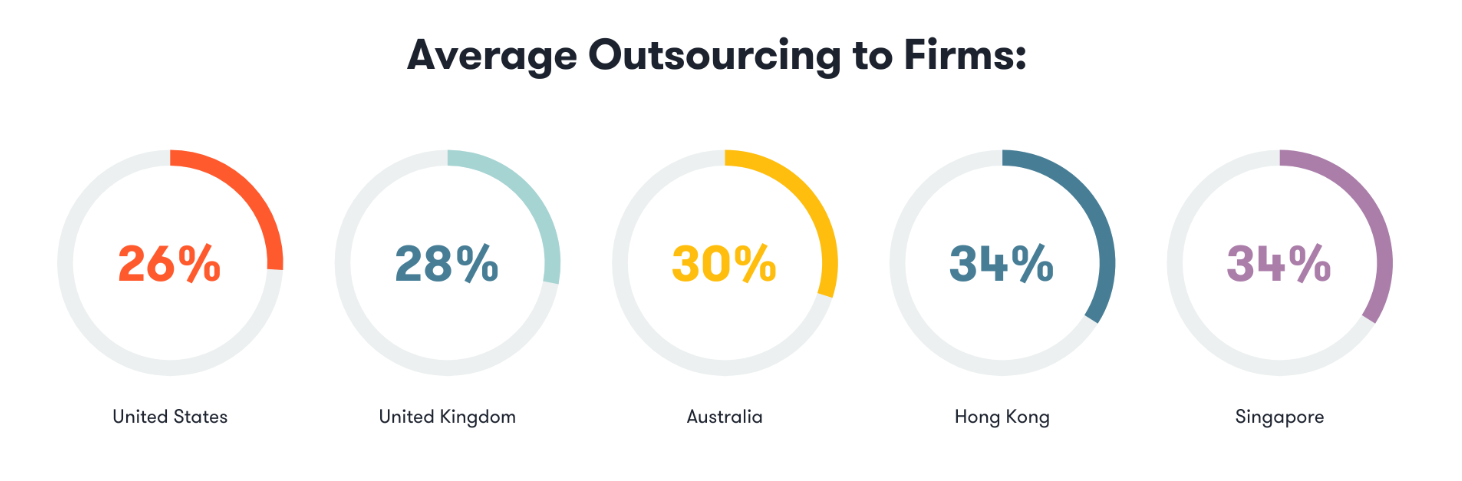

Facing resourcing gaps, GCs are still using traditional law firms to assist with their overburdened workloads. Average outsourcing to firms last year ranged from 25% in the US to 31-32% in Hong Kong and Singapore. The lack of in-house expertise and capacity were the top drivers across all markets.

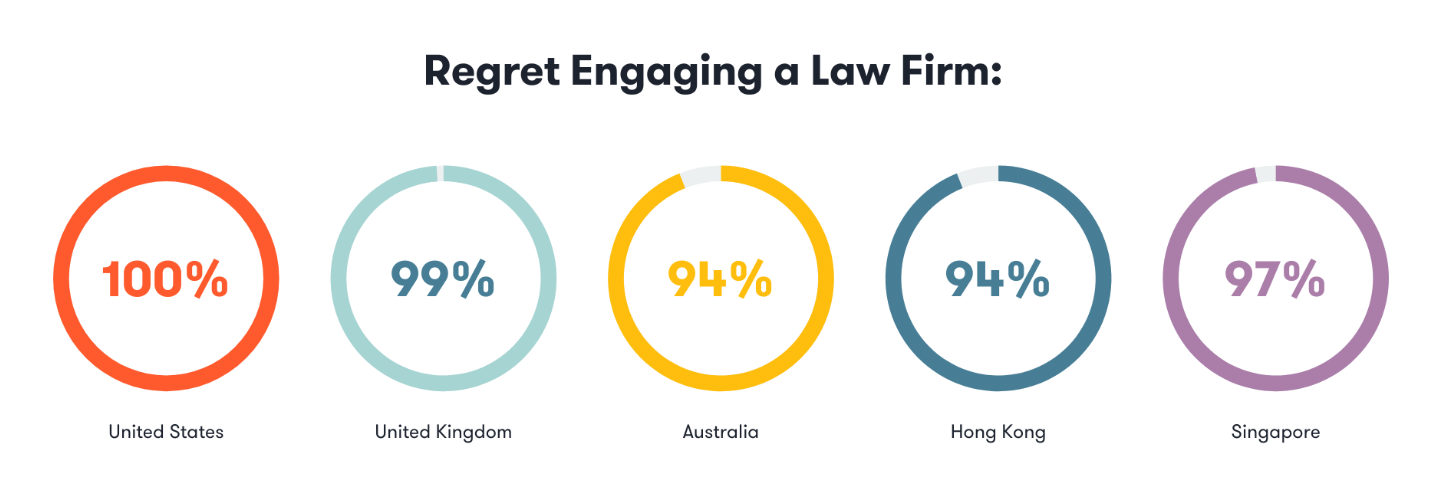

However, 96-100% of GCs had reasons to regret engaging law firms. Administrative inefficiencies, impractical advice, and lack of business acumen were common pain points. GCs estimate 35-49% of outsourced work could have been kept in-house with adequate staffing.

While 73-80% see law firms as potentially effective for complex matters, GCs are more likely to use them for specialized areas like mergers and acquisitions (M&A), data privacy, and emerging tech than routine work. Alternative fee arrangements are becoming increasingly common but also have limitations.

The Rise of Flexible Talent Solutions

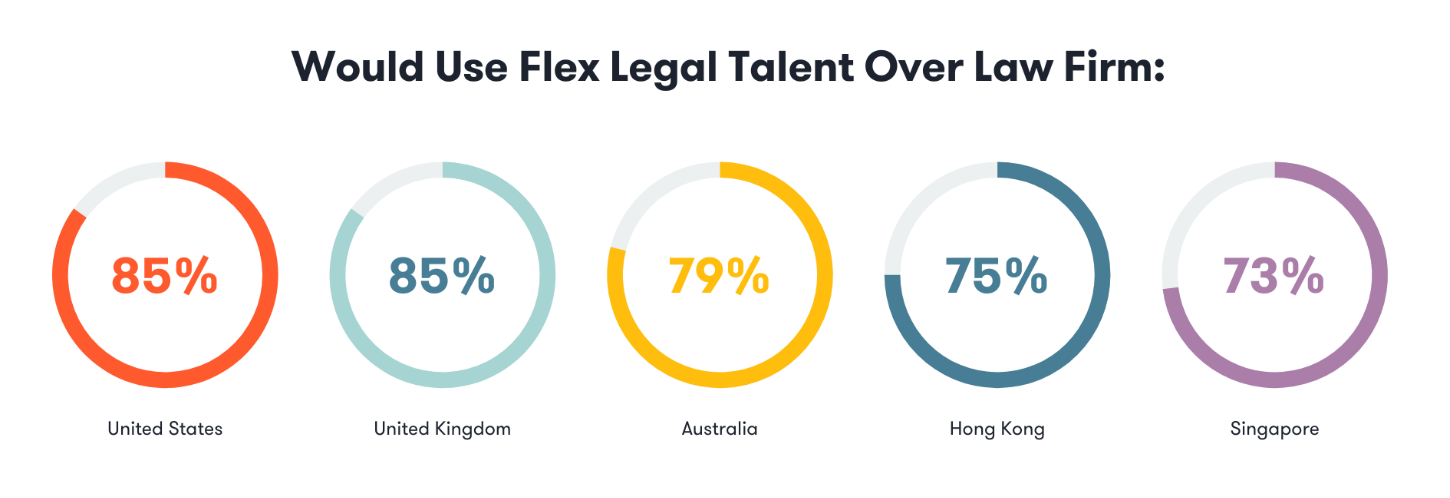

Facing these challenges, GCs are exploring flexible talent solutions to access experienced legal talent on-demand. 71-83% across markets see flex talent as a potentially effective solution, highest in the UK (83%) and lowest in Hong Kong/Singapore (62-63%).

77-91% would likely use flex talent over a law firm for equal quality at lower cost, including 22-32% who definitely would. Interest was highest in the UK (91%) and lowest in Hong Kong (77%).

In the next one to two years, GCs expect high demand for expertise in tech/product development (45-53%), data privacy (40-60%), and Artificial Intelligence/emerging tech (34-48%). High-quality flex talent could be especially valuable in these rapidly evolving areas.

The Path Forward: Agility and Innovation

While each market has unique nuances, the overall picture is clear: GCs worldwide need innovative solutions to navigate an increasingly complex legal landscape. Budget pressures are forcing departments to rethink how they resource legal work and safeguard their companies' values.

Traditional law firm support remains important for certain matters but has limitations in terms of cost, business alignment, and efficiency for routine work. Alternative legal service providers (ALSPs) and flexible talent solutions are emerging as a compelling way to access specialized expertise on-demand and build more agile, resilient legal departments.

GCs who embrace a multifaceted approach - leveraging a mix of flexible talent, law firms, and other modern legal solutions - will be best positioned to effectively protect their companies' interests and values in the face of economic uncertainty and evolving business needs.

For more details on the challenges, opportunities, and next steps for your market, download the full survey report for the US, UK, Australia, Hong Kong, or Singapore. Access data-driven insights to benchmark your department and inform your strategy for the future of your in-house legal function.

Posted by Kelsey Provow

Kelsey Provow is an award-winning writer and editor passionate about sharing unique and thought-provoking narratives. After obtaining her master's degree in professional writing, she has spent over a decade writing across multiple industries, including publishing, academia, and legal.